Tax Reform at SAP

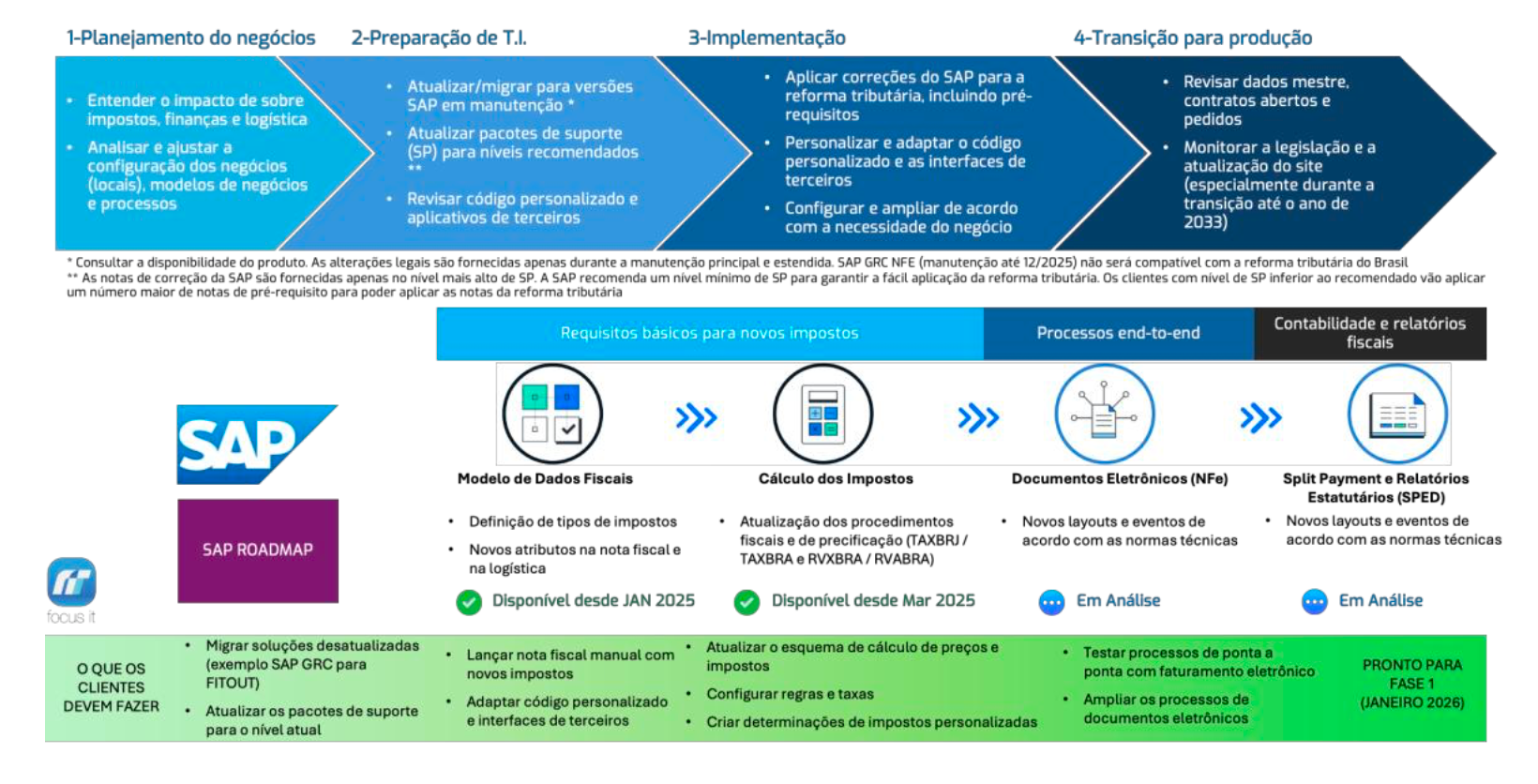

Tax Reform, established by Constitutional Amendment 132/2023, represents one of the biggest changes ever implemented in the Brazilian tax system. The gradual replacement of taxes such as PIS, COFINS, ICMS, and ISS with the new CBS, IBS, and IS will have profound impacts not only on tax calculations but also on the structure and internal processes of companies—especially those using SAP as a management system.

In practice, the transition will require adjustments across the entire tax chain: from the issuance of electronic invoices to compliance with new ancillary obligations and the reconfiguration of tax rules in the ERP system. The challenge is technical, fiscal, and operational. Companies that fail to anticipate risk being unable to adapt in time, compromising the continuity of their operations as early as 2026.

With a team highly specialized in tax compliance projects and extensive experience in SAP environments, FOCUS IT is prepared to guide your company through this transformation process with security, strategic vision, and a focus on results. Our approach goes beyond compliance: we seek to optimize processes and ensure that the company benefits from the transition, with full adherence to legal requirements and operational stability.

What FOCUS IT offers to ensure tax compliance:

Impact assessment: We identify priority action points in SAP ERP to comply with the new legislation.

We map critical tax processes, aligning with best practices in the flow between modules (FI, SD, MM, etc.).

Real-time validation: We ensure that SAP validates information at the point of origin to avoid accounting errors.

Automated monitoring: We track tax submissions through native SAP features, reinforcing tax control and accuracy.

How this adds value to your business:

- Correct issuance of NF-e and tax obligations under the new tax model required starting in 2026. Structured technical compliance, avoiding setbacks and operational rework.

- Mitigation of legal and tax risks, with optimized processes and an SAP system prepared for the transition.

- Continuous improvement, with full support in the new model, from diagnosis to technical support.

Our differentiator:

FOCUS IT is a leader in SAP Tax Compliance. We operate with proprietary solutions and consolidated know-how to support companies in planning and executing tax compliance with agility, security, and operational quality.