Physical and Fiscal Receipt Automation

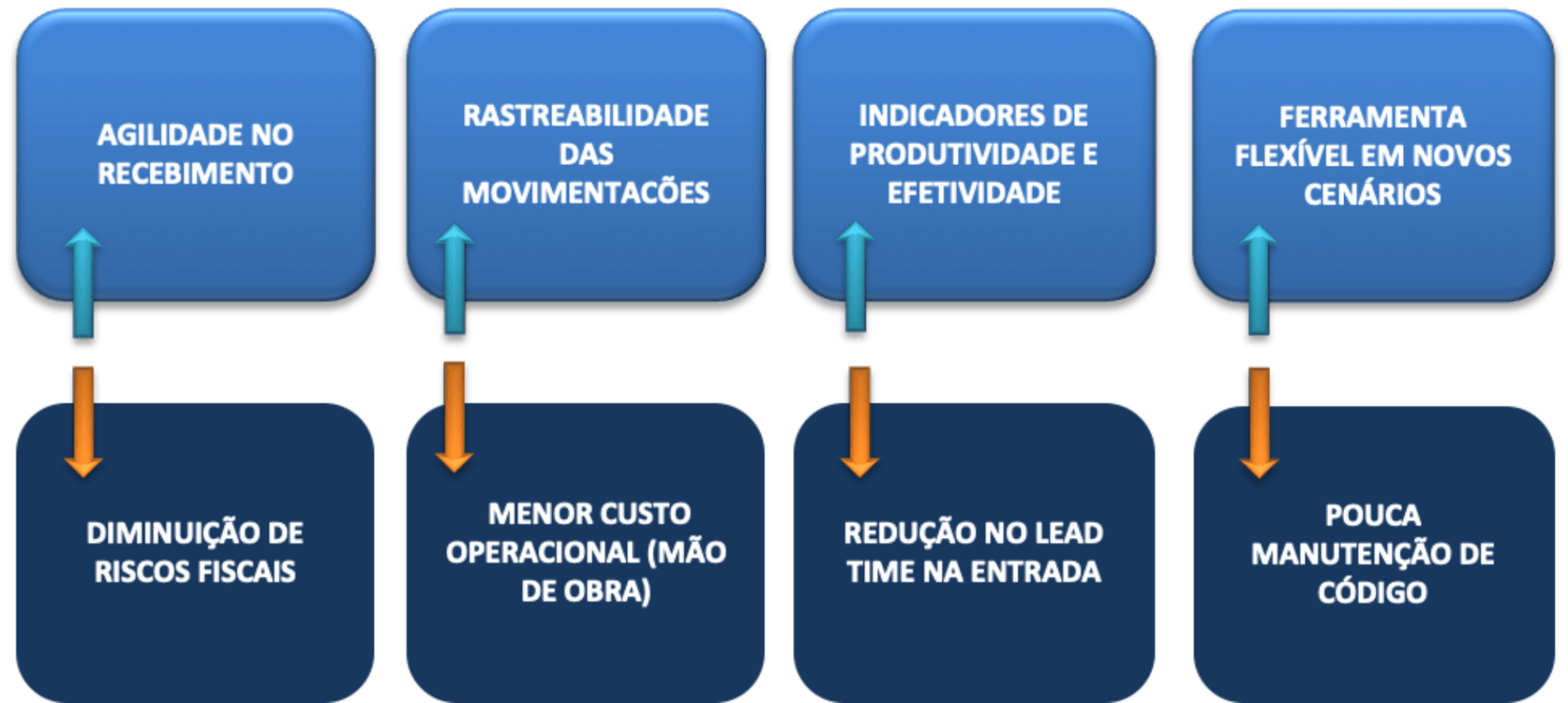

After the events of electronic tax documents, the processes of registration of tax operations gained great power of automation. Many companies have eliminated the bookkeeping typing of these documents and gained in productivity, but the biggest gain aspect has been the elimination of bookkeeping errors, either because of the elimination of typing and differences of interpretation at the time of registration, as to the anticipation of validation of the information before the operation takes place.

With this in mind, FOCUS IT has worked hard on its customer base, comprised of companies from various segments, and has created a very robust solution to enable automated bookkeeping of these electronic documents, focusing on compliance with tax legislation and adherence to the receiving process. physical and fiscal. This solution is built on ABAP and operates in the same operating environment as SAP ERP, eliminating the need for additional infrastructure and licensing.

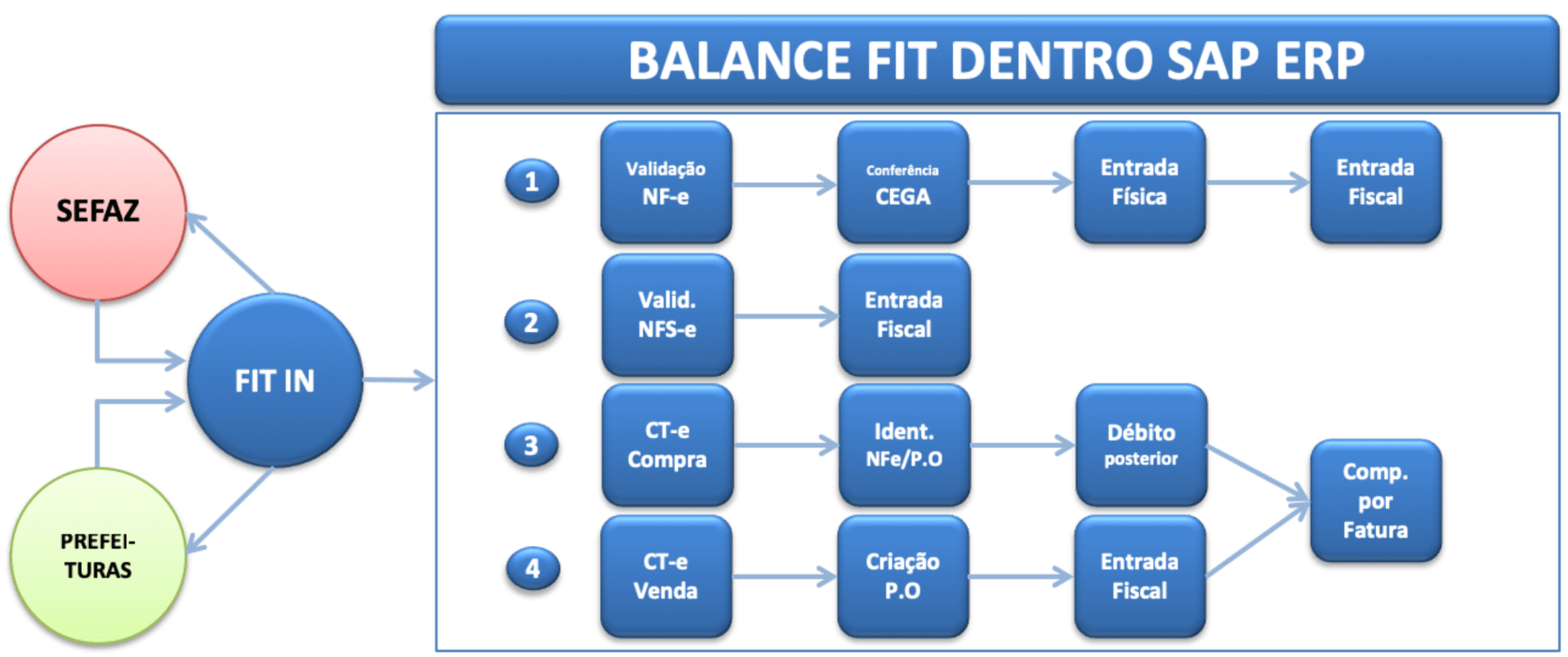

Using best practices for the receiving area in SAP ERP systems, the BALANCE FIT

solution securely and adherently automates the receipt and control of

electronic tax documents.

The FOCUS IT solution enables:

Comply with the tax legislation parameterized in the SAP ERP system of its customers, through early validation of electronic tax documents issued against the company's CNPJ, sending alerts in case of divergences;

Automatic alerts, according to the type of divergence found, triggering the operational area responsible for the divergent information. These are registered in a repository in BALANCE FIT and allow, through analytical views, decision making, aiming at process improvement and relationship with suppliers;

Automatic and programmed search on the websites of the competent agencies of electronic tax documents, without the need for manual interventions.

The search is performed by the FOCUS IT message called FIT IN;

Carrying out the bookkeeping operations of goods and services, processing the digital files of invoices, bills of lading, transport manifest and invoices of services;

Carrying out the bookkeeping operations of goods and services, processing the digital files of invoices, bill of lading and transportation manifest.

Automatic issuance of knowledge manifest events of the operation at the time of the digital file download and its confirmation or refusal, after the document's fiscal entry;

Possibility of configuring, in the BALANCE FIT solution itself, a flexible and complete blind counting process upon physical receipt of materials in the company;

The ease of use by users of SAP ERP, as it has the traditional presentation format of other standard SAP features, avoiding disruption and the need for an adaptation period;

Perform the SAP ERP MIGO and MIRO functionality with the click of a confirmation button once all relevant data has been validated in advance and the blind count process has been performed;

In the case of bill of lading, it allows you to automatically create your purchase orders, making the full SAP ERP reports available to you, streamlining the process. It also consolidates these with their respective subsequent invoice, and the configuration is as needed by the company process;

Dedication to more administrative functions in the logistics and tax area, providing quality in the process rather than operating mechanically in the manual typing and checking of electronic documents.

FOCUS IT has its own know-how to maintain and sustain this tax solution, anticipating the tax trends and technological developments inherent in these tax obligations. With the experience gained in the various tax projects and various segments served, FOCUS IT can assist in defining optimized processes.

Talk to us